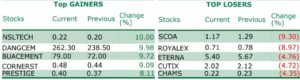

The equities market closed the day in green as gains from DANGCEM (9.98%), BUACEMENT (9.72%), VITAFOAM (6.70%) and TRANSCORP (6.09%) dropped the NGX-ASI and market capitalisation by 2.90% to close at 46,232.37 points and NGN25,181.53 billion respectively. Hence, the Year-to-Date declines to 8.23%.

Sentiment in the market slumped as volume traded decreased by 59.79% (146.51 million units) while value traded witnessed a 14.40% (NGN1,548.55 million) decline. TRANSCORP had the most volume traded while ZENITHBANK retained it position as the highest value traded.

Market breadth improved to 2.55x owing to twenty-eight (28) gainers and eleven (11) laggers.

Performance across sectors was positive as the Banking sector (1.82%), Insurance sector (3.66%), Consumer Goods sector (0.33%), Oil & Gas sector (0.65%) and Industrial sector (9.25%) gained.

Fixed Income Market

Long term instruments in the Bond market witnessed significant sell offs, leading to the 13bps increase in average yield to settle at 14.75% from 14.62%. The 27-MAR-2035 had the highest movement during the day, rising by 44bps.

Yields in the Nigeria Treasury bills, and OMO market declined marginally across the curve. This led to the 1bp decrease in average yield to settle at 10.97% from 10.98% at the Nigerian Treasury bills market and 10.80% from 10.81% at the OMO market.

System liquidity improved further by 30.03% closing at a negative balanceřof NGN115.64billion from a negative balance NGN115.64billion, this however didn’t impact the performance of the Open Buy Back and Overnight rate, as the rate stood still at 17.13% and 17.25%.

Naira increased at the Importers and Exporters Window to close at NGN446.00/USD, depreciating by NGN0.50/USD.

Ifunanya Ikueze is an Engineer, Safety Professional, Writer, Investor, Entrepreneur and Educator.