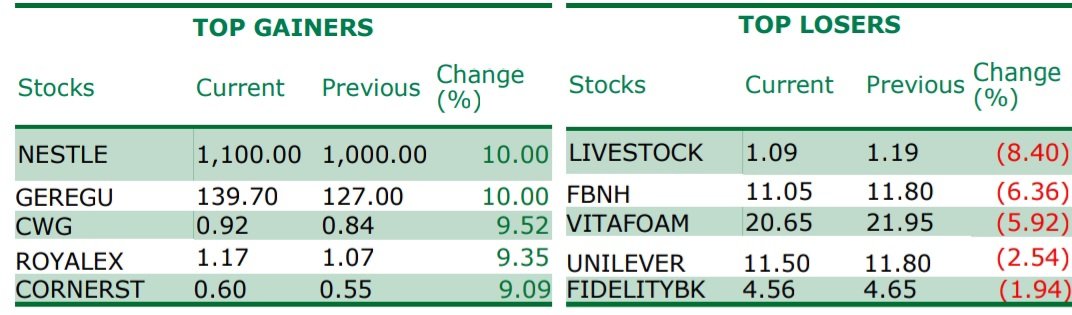

(Greenwich Merchant Bank): Positive sentiment persist in the equity market as the NGX-ASI and Market Capitalisation drove up by 0.73% to settle at 50,300.00 points and NGN2.73 trillion respectively. This is as a result of an increase in the price of NESTLE (10.00%), GEREGU (10.00%), NB (9.04%) and UACN (8.82%). Consequently, Year-to-Date stands at 17.75%.

However, market activity was mixed as volume decreased by 0.51% while value traded increased 106.06% to rest at 490.48 million units and NGN7.57 billion respectively. FBNH and GTCO held the position as the highest traded volume and value for the trading day with 78.64 million unit and NGN 922.553 million respectively.

Market sentiment was balanced as thirty-fivet (35) gains and seven (7) losses were recorded, hence, market breadth stood at 5.00x.

Sectoral performance continues it bullish streak as Consumer Goods sector (3.65%), Industrial sector (0.14%), Insurance sector (1.84%), Oil & Gas sector (2.82%) and Banking sector (0.27%) all recorded gains for the day.

Fixed Income Market

The NT-bills yields curved changed slightly from previous trading day, decreasing by 15bps. Thus, average yield stood at 5.29% from 5.44%. As well, system liquidity rose by 92.48% to settle at 701.33 billion from 364.39 billion.

Open Buy-Back and Over-night rate decreased to 9.50% and 9.83% from 10.75% and 10.83% respectively.

The OMO market closed lower as activity was recorded in the long-end of the curve hence average yield fell to 3.36%.

In the Bonds market, Movements were recorded across the short end of the bond curve and the mid end, therefore decreasing the average yield by 1bps to settle at 13.31% from 13.32%. The 23-Mar-25 instrument was the most bought with 16bps.

Ifunanya Ikueze is an Engineer, Safety Professional, Writer, Investor, Entrepreneur and Educator.