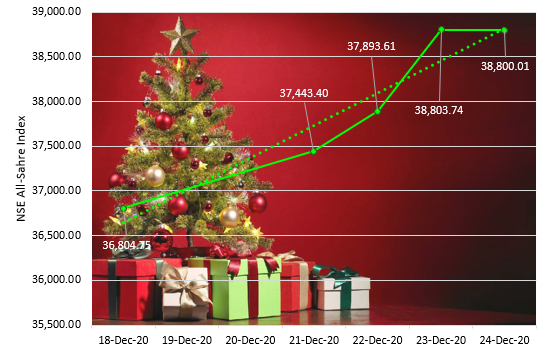

Trading on the floor of the Nigerian Stock Exchange (NSE) in the week of closed positively, giving Investors a perfect Christmas gift. The All-Share Index advancing by 5.42% in the three and half day week.

The Market Capitalization also rose by 5.42% to N20.279 trillion, giving Investors a N1.042 trillion Christmas gift.

The first of day of trading in the Christmas week started with a 1.7% gain for both the NSE All-Share Index and the Market Capitalization following buying interest in Dangote Cement Plc and Lafarge Africa Plc shares.

On Tuesday, the index and market cap. rose by 1.2%, continuing its gaining steak, underpinned by continued buying interest in Dangote Cement Plc shares.

- Read also; Domestic Economy: National Assembly Approves 2021 Budget, Raised Up Figure by NGN505.6bn

- CBN revokes operating licences of some Payment Service Providers

Wednesday returned an even better performance, as the benchmark index advanced by 2.4%, setting a confirmatory stage for the Christmas gift. The advancement on Wednesday was on the back of gains in Airtel Africa Plc and BUA Cement Plc shares.

Thursday recorded the first decline of the index in almost two week, the NSE All-Share index lost 0.01%. It was a half-day trading session, as the market closed early because of Christmas.

The Federal Government of Nigeria declared Friday 25th of December, 2020 as Public Holiday in commemoration of the Christmas Celebration, consequently the market was closed on Friday.

A total turnover of 2.756 billion shares worth N40.311 billion in 17,459 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 1.893 billion shares valued at N17.647 billion that exchanged hands last week in 20,660 deals.

The Financial Services Industry (measured by volume) led the activity chart with 2.106 billion shares valued at N19.454 billion traded in 8,327 deals; thus contributing 76.40% and 48.26% to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 182.099 million shares worth N4.392 billion in 2,485 deals. The third place was Industrial Goods Industry, with a turnover of 145.808 million shares worth N10.632 billion in

2,587 deals.

Trading in the top three equities namely Access Bank Plc, Zenith Bank Plc and AXA Mansard Insurance Plc (measured by volume) accounted for 1.439 billion shares worth N13.881 billion in 2,972 deals, contributing 52.23% and 34.44% to the total equity turnover volume and value respectively.

The activity level improved in the week, as the volume of shares traded increased by 45.61% while the value of traded shares also increased by 128.43%.

Fig 1: Investogist Activity Chart – NSE All-Share Index vs Activity level (measure of volume and value of traded shares)

Fig 2: Investogist Activity Chart – Market Capitalization vs No of deals

At the end of trading on Thursday, 24th December, the NSE ASI was up by 44.55% YTD. The performances of the 5 indices under our watch so far this year are presented below;

- Industrial Goods Index: +72.88%

- Insurance Index: +48.04%

- Banking Index: +10.76%

- Consumer Goods Index: -2.81%

- Oil & Gas Index: -14.01%

In the week ending 24th December, 2020, all indices under our watch advanced except the Banking Index;

- Industrial Goods Index: +12.05%

- Insurance Index: +6.01%

- Oil & Gas Index: +1.38%

- Consumer Goods Index: +0.28%

- Banking Index: -1.03%

Thirty- five (35) equities appreciated in price during the week, lower than fifty-three (53) equities in the previous week. Eighteen (18) equities depreciated in price, higher than seventeen (17) equities in the previous week, while one hundred and eight (108) equities remained unchanged, higher than ninety-one (91) recorded in the previous week.

Top gainers and losers in the week are;

Fig 3: Top gainers and losers. Source – NSE Weekly Report

Scheme of Arrangement between UPDC and its Shareholders

Dealing Members are hereby notified that UACN Property Development Company Plc (UPDC or the Company) has through its stockbroker, Stanbic IBTC Stockbrokers Limited, informed The Nigerian Stock Company Exchange (The Exchange) that the Company has obtained the approval of the Securities and Exchange Commission for the Scheme of Arrangement between UACN Property Development Company Plc and the owners of its fully paid ordinary shares of 50 kobo each (the Scheme).

The Scheme of Arrangement involves a capital reorganization with the unbundling of a substantial portion of UPDC’s interest in the UPDC REIT to all UPDC shareholders. With the unbundling, UPDC’s shareholders will have continued exposure to UPDC, in addition to direct access to the returns from UPDC REIT. Under the Scheme, each eligible shareholder will receive Scheme units based on the allocation ratio. Subsequent to the Scheme becoming effective, eligible shareholders will hold shares in UPDC, as well as units in UPDC

REIT.

The Effective Date for the Scheme is Thursday, 24 December 2020 while the Qualification/Eligibility Date is Monday, 21 December 2020.

Bonds

A total of 488 units valued at N499,807.41 were traded this week in 11 deals compared with a total of 47,699 units valued at N53.129 million transacted last week in 22 deals.

ETPs

A total of 645,669 units valued at N2.009 billion were traded this week in 33 deals compared with a total of 412,358 units valued at N1.396 billion transacted last week in 40 deals.

Outlook

We are cautiously expect the market overall direction to remain positive, as Investors start taking positions of dividends in upcoming weeks. The season of Christmas gift might as well extend into the new year.

By; Nnamdi M.